How to get your Social Security Number

Our service saves you time and eliminates the need for extensive research. With just a few clicks, you can start the process of obtaining your new social security number, making your transition to living and working in Germany a smooth and stress-free experience. If you do not yet have statutory health insurance – click here. A printer is required. And dont’ forget to read our extensive FAQ’s on this topic.

Get your Sozialversicherungsnummer

in Germany

The most important facts on social security in Germany

German bureaucracy is not easy. We are here to help you!

FAQ – Social security number in Germany

Table of contents:

What is the social security number in Germany?

In Germany, a Social Security Number (Sozialversicherungsnummer) is a unique identifier assigned to individuals for the purpose of tracking their contributions to the country’s social security system. It is used by various government agencies, financial institutions and employers to verify an individual’s identity and eligibility for various benefits and services, such as health insurance, unemployment benefits, pension and retirement benefits, and others. The Social Security Number in Germany is a combination of numbers and letters, and is an important piece of personal information that must be kept confidential to prevent identity theft and other forms of financial fraud.

You need your German social insurance number for several reasons, including your employer who needs this number to take pension contributions from your paycheck. If you plan on leaving Germany, you will also need this number to receive your pension payments. If you don’t have your social insurance number yet, there’s no need to worry as your employer will still pay you.

In Germany, the social security number and social insurance number refer to the same thing and have several equivalent names including:

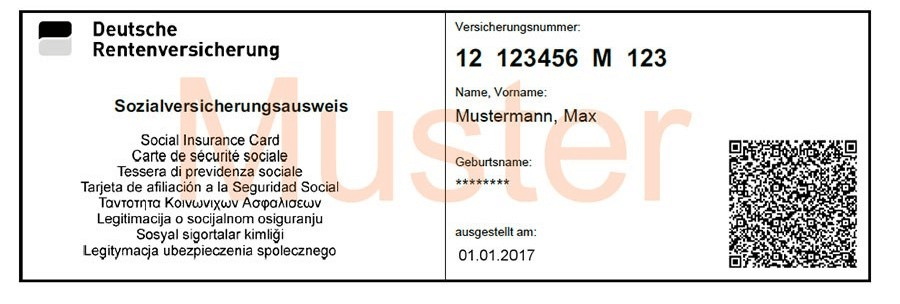

What Does The Social Security Number In Germany Look Like?

The German social insurance number consists of four parts and is formatted as follows: 12 123456 M 1231. The first part represents the area number of the office that registered you. For example, if you were registered in Berlin-Brandenburg, the area number would be “04”. The second part is your birth date, represented as six digits. For instance, if you were born on September 23, 1992, it would be “230992”. The third part is the first letter of your last name, and the final part is used to differentiate you from others with the same name and birth date.

What is the social security card in Germany?

The social security card in Germany, also known as the Sozialversichertenkarte, is a physical representation of an individual’s unique social security number. It is used as proof of an individual’s enrolment in the country’s social security system and contains their name, date of birth and social security number. The social security card is usually issued by the pension or health insurance scheme and is required to access certain benefits and services. The card is usually presented to employers, healthcare providers and other organisations as proof of an individual’s eligibility for various benefits and services. It is important to keep your social security card safe as it contains sensitive personal information and is considered a valuable document.

What do I need to get a German social security number?

In order to obtain a German social security number, you must first have a valid residence permit. This means you will need to have completed the Anmeldung process. Having a job is not a requirement for obtaining your social security number. Your employer can hire you and start paying you before you receive your number, but it’s important to let them know as soon as you receive it.

How to get social security number in Germany?

Obtaining a social security number in Germany is a necessary step for anyone intending to live, work or study in the country for an extended period of time.

The SSN or social security card in Germany is a crucial document that serves as proof of your enrollment in the country’s social security system. This number is not automatically assigned to individuals, and it is important to actively apply for it in order to access the benefits and services provided by the German social security system.

One of the primary reasons for obtaining a national insurance number is to provide proof of your enrollment in the social security system to your employer. In most cases, you will need to have your national insurance number before your first day of work. This is because it is required for paying into the social security system and accessing the benefits and services that come with it.

In order to apply for your national insurance number, you must be registered in Germany. Register here! There are two main ways to apply for the number, depending on whether you have statutory health insurance or private health insurance:

Statutory health insurance

The quickest way to obtain your German social security ID is by enrolling in a public health insurance program. This will automatically register you in the German social security system. The big public health insurance organizations are Barmer, Techniker Krankenkasse (TK), AOK and DAK.

You will receive a letter from the German pension fund, which will include your social security card (Sozialversicherungsausweis) and your insurance number, within 4 to 6 weeks of enrolling in your public health insurance plan. It is important to keep this document in a safe place.

If you need your number sooner, you can request a membership confirmation (Mitgliedsbescheinigung) from your health insurance provider, usually available within 3 to 4 days of enrolling. Many public health insurance funds offer this service online for your convenience.

Private health insurance

If you are not member of a German public health insurance, you cannot use the application form on our website to apply for your social security number.

If you have private health insurance or expat health insurance, you will not receive a Social Security Number automatically. You will need to contact the Deutsche Rentenversicherung (German Pension Office) and ask for one. You can either visit a local branch in person, or have your health insurance broker or employer assist you with the application process.

It typically takes 1 to 6 weeks to receive your Social Security Number by post to your German address, but most of the time it takes less than 2 weeks. If you need it urgently, you can visit your local Deutsche Rentenversicherung branch and obtain it on the same day.

You will receive a Social Security Card, also known as the Sozialversicherungsausweis, in a letter from the Deutsche Rentenversicherung.

Follow these steps to make an appointment at Deutsche Rentenversicherung to get your social security number:

Sometimes your employer will apply for your SSN number

If you’ve recently been hired for your first job in Germany, your employer may assist you in obtaining your social security number. This process can be done through their digital payroll system.

After your employer has registered you, you should receive your official letter from the German pension fund, including your Sozialversicherungsausweis (social security card), with your insurance number. This usually takes between 4 to 6 weeks and is delivered to your German address. It’s important to keep this document in a safe and secure place.

How to apply for German social security number online?

To apply for your German social security number online, you must be a member of a German public health insurance (gesetzliche Krankenversicherung).

You can use our online form:

Using our service to apply for a new German social security number offers many benefits. By using our service, you do not need to speak German, which eliminates the stress of navigating a foreign language. Our online form is easy to use and available in English, and we take care of the translation and preparation of the necessary documents. Our team also prepares a personalized cover letter to accompany your documents, ensuring that the process is seamless and efficient. Furthermore, our service saves you time and eliminates the need for extensive research. With just a few clicks, you can start the process of obtaining your new social security number, making your transition to living and working in Germany a smooth and stress-free experience.

In theory, all German officials should have a basic knowledge of English. However, this is not always the case.

You can always go to your local pension office in person and ask for help. However, be aware that there may be long waiting times if you have not made an appointment. Make sure you bring all the necessary documents with you (copy of your passport, etc.). Ideally, bring a German-speaking friend with you.

If you want to do it yourself here are the steps to follow:

Note that the process and requirements may vary depending on the insurance company, so it’s best to check their website for specific instructions.

How long does it take to get a social security number in Germany?

The time it takes to receive a social security number in Germany can vary, but it typically takes a few weeks. Once your application is complete and you have all the necessary documents, the German pension office will process your application. They will then issue you a social security number, which you should receive within several weeks. It’s important to apply for your social security number as soon as possible.

Where to find my social security number?

You can find your German social security number (SSN) on various official documents, such as your social security card, pay stubs, or health insurance documents. You may also find it on documents from the German pension office or the German tax office. Additionally, your employer should have your social security number on file and can provide it to you if you need it. If you have trouble locating your social security number, you can contact the German pension office (Deutsche rentenversicherung) for assistance.

I lost my German social security number: What to do?

If you cannot find your social security number, you may need to apply for a new one.

If you have lost your German social security number, don’t worry. Our Social Security Number application service is here to help. With our easy-to-use online form, you can complete the application process in English, without the need to speak German.

Our team will translate the form into German and send it to the relevant health or pension insurance company, along with a personalized cover letter. The process is quick and hassle-free, saving you time and research.

After a few weeks, you can expect to receive your new Social Security Number in the mail. Simply fill out the form on our website and let us handle the rest. With our reliable and efficient service, you can get your Social Security Number back in no time.

Conclusion: Sozialversicherungsnummer Deutschland

Having a social security number is a mandatory requirement for anyone who works in Germany. It is the key identifier for your social security and pension insurance records, which will ensure that your rights and benefits are protected in case you retire, fall ill, long-term care or become unemployed. The process of obtaining your social security number is relatively straightforward, and can be done either through your public health insurer, employer, or German pension insurance fund.

Once you have been registered, you will receive your Sozialversicherungsausweis (social security card), including your unique SSN number, via postal mail. This card will be sent to your German address, usually within 4 to 6 weeks. In some cases, if you are registered through your employer, you may receive the card faster.

It is important to keep your social security card in a safe place, as it will be needed for various official purposes in the future. Whether you are a citizen or a foreign worker, having a social security number in Germany is essential to ensure that you are fully covered by the social security and pension insurance systems, and to enjoy the benefits and rights that come with it.

Social Security Number in Germany