Private health insurance in Germany

Private health plans cover a wider choice of medical and dental treatment and generally provide broad geographical coverage. By having private health insurance you are considered a private patient and can expect a higher level of service from the medical profession.

You may choose a private health insurance (Private Krankenversicherung or PKV) instead of the government health plan if your gross income is above the annual income threshold (in 2023: 66,600 euros). Self-employed persons, German civil servants and those persons working part-time and earning less than 520 Euros per month are also eligible. Read our FAQ’s about private health insurance in Germany!

Your Options

In Germany, private health insurance (PHI) is an option for individuals who earn above a certain income threshold, are self-employed, or do not qualify for statutory health insurance (SHI). According to a 2020 report by the Federal Statistical Office, approximately 9.1 million people, or 11% of the population, were covered by PHI in 2019. Read our FAQ’s about private health insurance in Germany!

Care Concept– Get Private Health Insurance for limited time

Ottonova– Get Private Health Insurance for Expatriates

Apply online: Get Care Expatriate Health Insurance

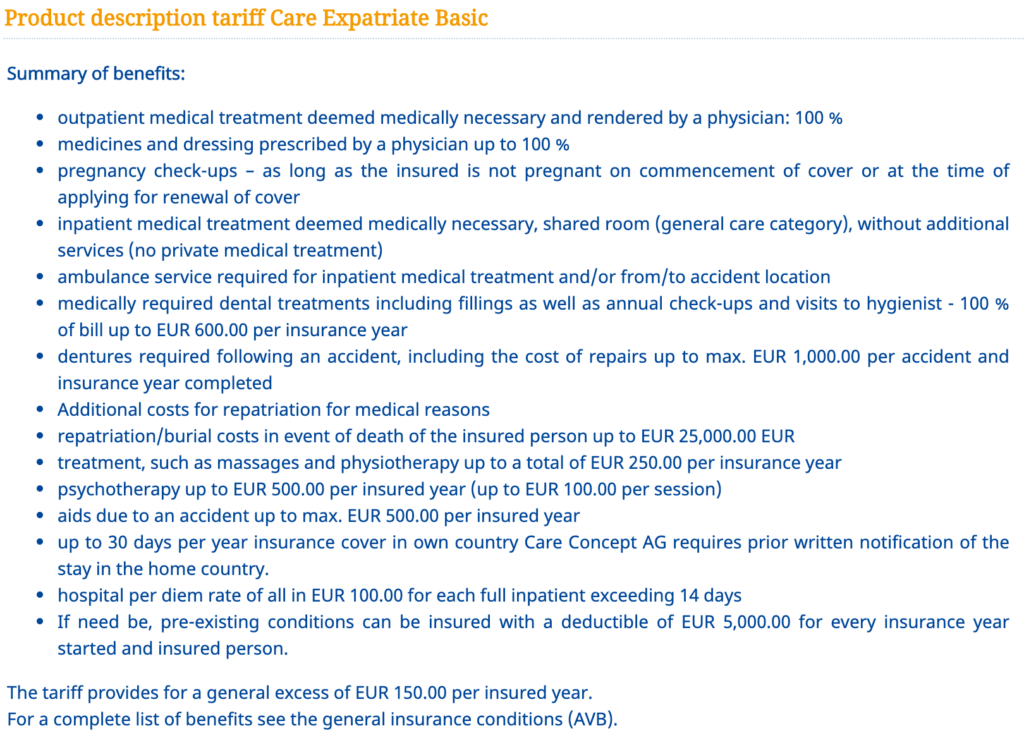

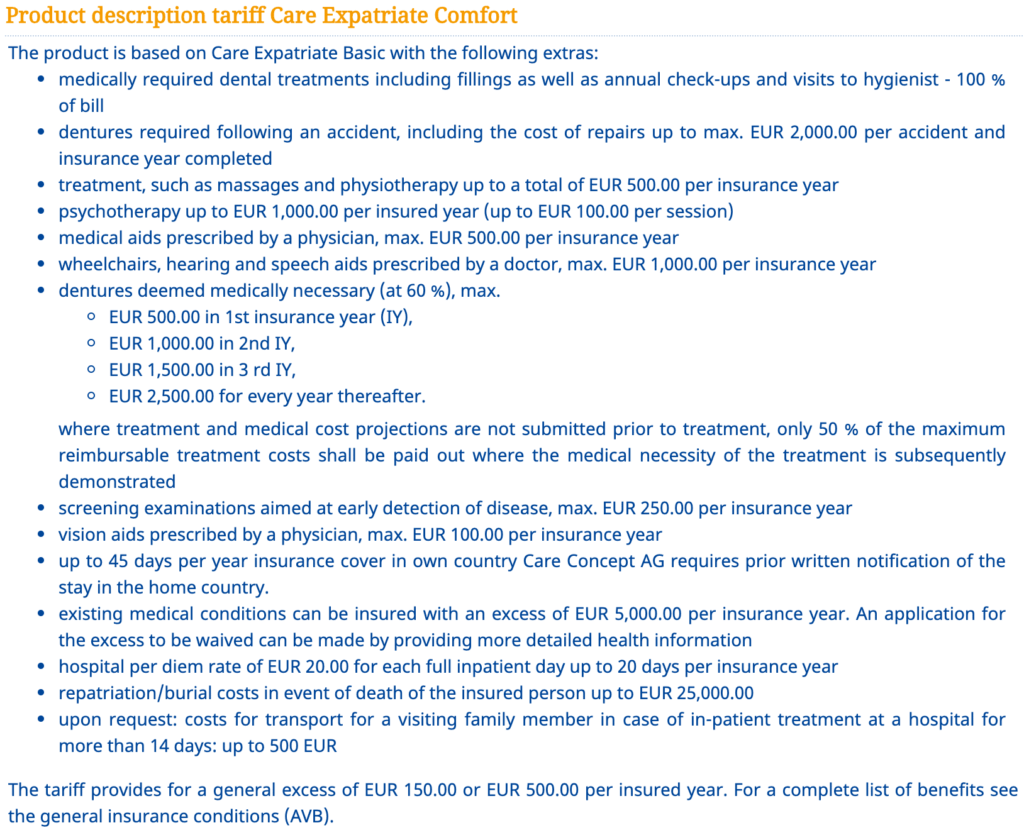

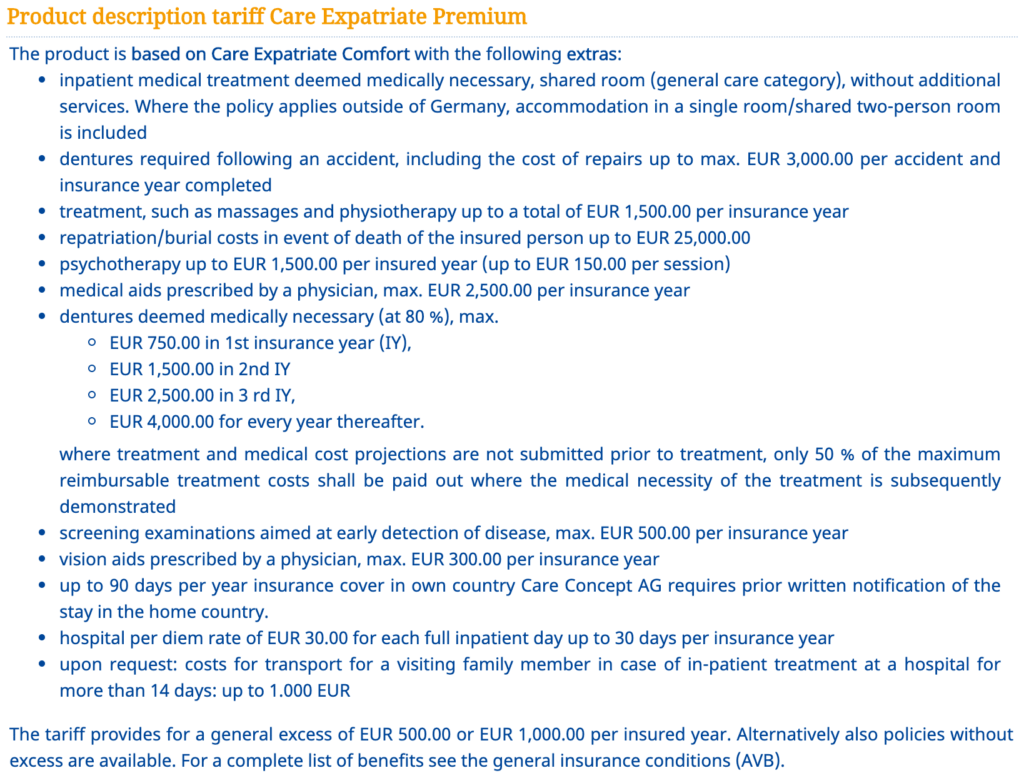

CareConcept – Care Expatriate

The Care Expatriate policy is tailored to the needs of private and business travellers and those on business assignments or emigrating worldwide. Health insurance can be taken out for long-term trips (stay abroad for at least 6 months up to a maximum of 5 years) up to a maximum entry age of 74 years.

Care Expatriate international health insurance is a comprehensive plan designed to meet the unique needs of private and business travelers, as well as individuals on global assignments or those emigrating worldwide. The coverage is suitable for long-term travel, ranging from stays abroad of at least three months to a maximum of five years, with a maximum entry age of 74.

The policy offers various benefits, including outpatient, inpatient, and dental treatment, as well as examinations, treatment, and care by licensed physicians worldwide at local standard rates. In Germany, the maximum insurance period is five years, while outside Germany, you can extend your contract as many times as you want, up to the maximum age limit.

For the initial insurance policy of five years with a geographical area of validity outside Germany, there is a one-time acceptance guarantee for a follow-up insurance policy, up to a maximum of five additional years (Care Expatriate Comfort / Care Expatriate Premium). Moreover, the insurance covers newborns, regardless of pre-existing conditions.

It is advisable for business travelers and individuals traveling abroad for work to consider the daily sickness allowance policy, “Care Cash.” This insurance policy covers loss of income due to prolonged illness.

In summary, Care Expatriate international health insurance offers comprehensive coverage for individuals on extended stays abroad, with flexible options to meet their unique needs.

It’s as simple as that!

*Many users got the Care Economy Package and this was sufficient for their visa; others were asked by the Auslanderbehörde to get a Care Concept Package costing at least 100,- €/ month so that it be the equivalent to the value of public health insurance.

Here you will find an overview of all Care Concept insurances and their costs. Insurances & Tariffs.

Expat travel insurance for longer stays abroad starts at €58.00 per month and is an excellent choice for anyone who wants to live and work in Germany for a limited period (up to 60 months).

Apply online: Get Private Health Insurance

ottonova – German Health Insurance for Expats

Save on health insurance. Get a whole lot more.

You can save a lot of money if you sign up with ottonova, and still get much better coverage compared to public health insurance. Non-EU Expats can save even more, by joining our special expat tariff.

It’s as simple as that.

The cost of private health insurance with ottonova varies depending on factors such as age, health status, and the level of coverage selected. Generally, private health insurance is often more expensive than public health insurance in Germany, but may offer additional benefits and more comprehensive coverage.

To get an idea of the cost of ottonova’s private health insurance plans, you can use their online calculator tool, which allows you to enter your age, sex, and desired level of coverage to get an estimated monthly premium. However, keep in mind that the actual cost may differ based on your individual circumstances.

Example:

Assuming that the applicant has no pre-existing conditions, the total monthly premium for ottonova’s Business Class 100 tariff is €644.80. This includes a basic contribution of €487.91, a daily sickness allowance of €48.72, premium relief in old age of €60.02, and long-term care insurance of €48.15.

Since the applicant is a salaried employee, their employer is required to contribute to their health insurance. After deducting the employer’s contribution of €322.41, the applicant’s monthly contribution would be €322.39.

It’s important to note that this is just one example calculation, and the actual cost may vary depending on factors such as age, health status, and level of coverage.

Why is the Expat tariff cheaper?

Ottonova’s private health insurance includes a special Expat tariff designed for non-EU citizens with temporary work visas who plan to stay in Germany for up to five years (60 Month). This tariff provides comprehensive coverage for medical services and offers tailored benefits for a good price to meet the unique needs of expatriates. With ottonova’s Expat tariff, non-EU citizens can have peace of mind knowing that they have access to high-quality medical care while working and living in Germany.

If Germany is your home country for at least the next couple of years, travel insurances are not a viable option for obtaining a visa in Germany as they are not compliant with §257 SGB V, §61(6) SGB XI. Unlike ottonova, these insurances also don’t contribute to the required long-term nursing care insurance (Pflegepflichtversicherung).

FAQ – Private health insurance in Germany

Table of Contents

Choosing Wisely: Private Health Insurance in Germany

When it comes to health insurance in Germany, employees and self-employed individuals should choose wisely. The benefits of private health insurance are attractive, but it is crucial to weigh the advantages against the disadvantages. Employers in Germany are obligated to pay half of the health insurance contributions for their employees, regardless of whether they have private or statutory insurance. However, the retirement subsidy from the pension insurance provider no longer covers half of the payable contributions. Instead, it only covers a small portion.

For self-employed individuals, the burden of paying for their health insurance lies entirely on them, both during their active working life and retirement. Therefore, it may be beneficial for them to stay insured in the statutory health insurance fund, despite the higher contributions initially. Since 2019, the German public health insurance has been more favorable for low-earning self-employed individuals, with lower minimum contributions.

Eligibility for Private Health Insurance

Not everyone can leave the public health insurance system in Germany, and it may not be recommended for those who can. Employees with a monthly income above the compulsory insurance limit of 5,550 Euros gross (66.600 Euros/ year in 2023) are eligible for German private health insurance. German social security income limits are set by law, and the federal government adjusts them annually. Full-time self-employed individuals and civil servants can take out private health insurance regardless of their income.

Differences Between Public and Private Health Insurance

German public health insurance and private health insurance (PKV) are regulated differently, with significant differences between the two systems. In private health insurance, insured individuals are no longer members of a general social welfare institution, such as German social security, but customers of a private company. Anyone considering switching to private health insurance should be aware of these differences.

Weighing the Benefits of Private Health Insurance

Choosing between public and private health insurance in Germany is a significant decision, with long-term implications that require careful consideration of the advantages and disadvantages. One should examine the benefits closely. Advantages of private insurance include higher benefits, such as treatment by a chief physician in a private hospital or accommodation in a single or double room. Additionally, many private health insurance packages offer higher reimbursements for dental prostheses than those provided by statutory health insurers. However, not all benefits are better. For example, many older private insurance contracts may not cover psychotherapy or home health care adequately. When selecting a suitable offer, it is crucial to ensure that all necessary benefits are included in the contract, as it is usually impossible to increase insurance coverage in the event of illness.

Considerations When Switching Health Insurers

Switching health insurers in Germany can be complicated, especially when it comes to pre-existing conditions. These conditions can result in high surcharges or even exclusion from insurance coverage. Additionally, privately insured individuals must navigate significant paperwork, as they are required to pay all medical bills, therapies, and medications themselves and then submit the bills to their insurance company for reimbursement. Moreover, individuals in their mid-forties and older are generally advised against switching insurers since they may face high premium increases at retirement age due to the aging reserves the insurer has saved not being enough to slow down the later increase in premiums.

Preserving Health Insurance Coverage with Anwartschaftsversicherung

An Anwartschaftsversicherung (entitlement insurance) can maintain the rights of private health insurance coverage during the period in which claims for benefits against other insurance carriers exist. This insurance guarantees that when benefits are resumed, either illness that occurred in the meantime is included in the insurance coverage (short expectancy), or additional aging provisions have been built up (large expectancy). For instance, police officers and soldiers entitled to a free medical care concept can secure the benefits of the private health insurance taken out early.

Qualifying Insurance for Unemployed Privately Insured Individuals.

Anwartschaftsversicherung for unemployed privately insured persons

For privately insured persons who have become unemployed, the entitlement insurance can also be useful, because in the case of unemployment there is automatically compulsory insurance in the statutory health insurance, provided that the 55th year of age has not yet been reached. If unemployment lasts less than one year, the insured person can revive his or her previous private insurance contract under the old conditions even without entitlement insurance. In addition, persons who have had private health insurance for at least five years can be exempted from compulsory insurance in the statutory health insurance at the beginning of unemployment.

Private health insurance (PKV) premiums in Germany are subject to adjustment, much like public health insurance premiums, due to rising healthcare costs. On average, premium income in both systems has increased by around three percent per year over the past decade. Private insurers also build up reserves to cushion premium adjustments and prevent uncontrollable premium increases in old age.

The higher the deductible, the more affordable private health insurance becomes. You can choose a specific amount of your annual medical costs to pay for yourself. It is crucial to select a deductible amount that you can afford to pay at any time, especially in the event of extensive treatment.

Some private insurers offer premium reimbursement options, where you receive up to three months of premiums if you do not use any services within a year.

Private Health Insurance Options for Students and Children

When students can no longer cover themselves through family insurance or student health insurance, they have the option of voluntary insurance in the GVK. Students pay the minimum monthly contribution of 160.11 euros, plus additional contribution and nursing care insurance. However, private health insurer costs for special student rates can start at around 90 euros.

Children require their coverage in private health insurance. If one parent is a civil servant, parents can cover their offspring for around 40 euros a month. If one parent is not entitled to benefits, the costs start at about 100 euros additional cost.

Subsidies for Privately Insured Pensioners

As a privately insured pensioner in Germany, you are entitled to a subsidy of 50 percent of private health insurance costs from your pension insurance provider. You must apply for this subsidy, ideally directly with your pension provider. The supplement is capped, and you will receive a maximum of 7.95 percent of your retirement as a contribution subsidy.

Private Health Insurance and Annual Income Tax Return

Regardless of whether you are required to file an annual income tax return or not, it may be worthwhile to do so. Contributions to private health and nursing care insurance are classified as pension expenses, just like contributions to a personal pension plan. You can claim your insurance contributions, as well as those for your privately insured family members, as extraordinary expenses in your tax return.

Contributions to compulsory long-term care insurance and supplementary nursing care insurance are fully tax-deductible in Germany. However, tax authorities only consider contributions for certain benefits for health insurance. Basic health insurance, which is similar to German public health insurance, is used as an orientation value. Additional benefits like a two-bedroom in a private hospital or treatment by a non-medical practitioner are excluded from tax reductions. Contributions for these additional benefits can be deducted as other pension expenses, but only if the maximum limits have not already been exhausted by essential health and nursing care insurance contributions. The maximum limit for other pension expenses is 1,900 euros for employees and civil servants and 2,800 euros for self-employed persons.

Basic Coverage & Social Insurance in Germany

Private health insurance companies in Germany are required to offer basic coverage that cannot reject insured individuals who meet the requirements. Surcharge or exclusion of certain benefits due to health risks are prohibited in the basic coverage, which is comparable to the scope of benefits in the GVK. The contribution for the basic coverage is recalculated annually and cannot exceed the respective maximum GVK contribution. If someone is unable to pay the fees, costs may be halved or subsidised by the primary security or social welfare agency. In Germany, statutory social insurance is the essential institution of social security and is regulated by law and organised by self-governing insurance carriers. Social insurance consists of five branches, including statutory health insurance, long-term care insurance, German pension insurance, unemployment insurance, and statutory accident insurance.

Private Health Insurance Costs for Families

Private health insurance can be expensive for families as there is no free co-insurance for children, spouses, or partners. Each individual needs a separate contract and contributions must be paid, which can cost at least 500 euros per adult and about 150 euros per child per month. As a result, employees and self-employed individuals may want to consider switching to private health insurance if they have family members covered by statutory health insurance without paying premiums.

Private Health Insurance for Pensioners and Retirees in Germany

Private health insurance fees can increase significantly in old age, even if you have less income, so it is essential to save enough money for retirement to pay for health care. Contributions to private health insurance are calculated independently of personal income, unlike in German public health insurance, which uses additional revenue from life insurance or rent to calculate contributions in retirement.

Upon retirement, the agreed private health insurance coverage remains in full force, except for daily sickness allowance insurance, which ends when a retirement pension is drawn. Insured persons who have taken out a premium reduction tariff as a pension provision pay a lower premium from the age agreed in the conditions.

Former civil servants pay lower premiums for their health insurance when they retire because the benefit rate usually increases from 50 to 70 percent upon retirement. The amount of insurance that the individual must finance is reduced to 30 percent of medical costs from the start of retirement, reducing the insurance premium.

State employees are entitled to free medical care during their active period, but they must take out private health insurance at the latest upon retirement. A qualifying insurance policy can be taken out at an early age to ensure an average insurance premium even in the event of illness and despite the higher age when switching to private health insurance.